- Templates

- Government forms

- Schedule M-3 (Form 1120-L) - Jan 2020

Schedule M-3 (Form 1120-L) - Jan 2020

Schedule M-3 (Form 1120-L) is used to reconcile financial statement net income (loss) for the corporation with taxable income (loss) before net operating loss (NOL) deduction, and specifies the differences between financial statement income and taxable income.

Originally published by: irs.gov

Used 3 times

Effortlessly edit PDFs anywhere

- Save time and tackle any paperwork task with ease

- Handle confidential information and signatures securely

- Send work, negotiate terms and sign everything off with Lumin Sign

Frequently asked questions

One platform for all your PDF tools

Bring your work to life with our comprehensive suite of PDF editing tools. Share, edit and comment on documents in the cloud to make teamwork seamless.

eSign a PDF

Create a unique eSignature and sign documents in seconds.

Edit PDF text

Stop converting your PDFs and edit text right where it is. We can even match font!

Collaborate live

Share feedback, action items and edit documents in real time.

Merge PDF files

Combine multiple documents and reorder them to create one perfect PDF.

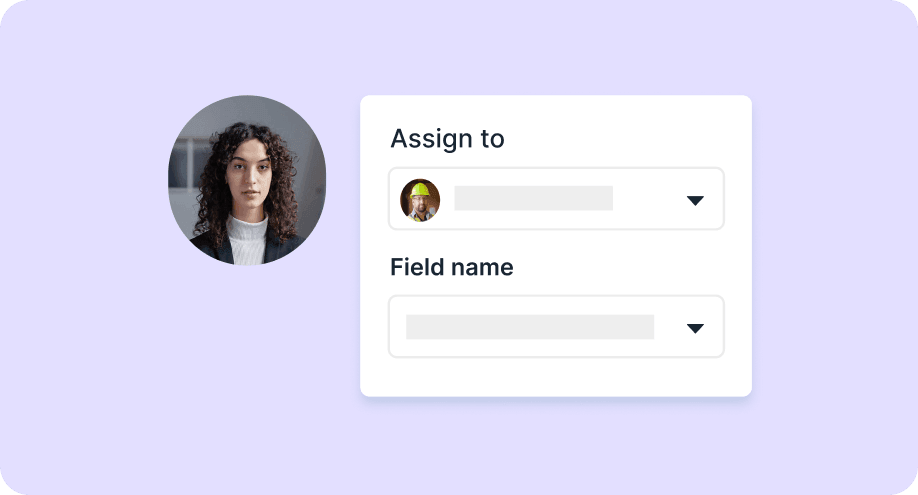

Fillable forms

Make paperwork easy by creating forms with fillable fields.

Discover Lumin’s products

Collaborate with existing colleagues and onboard new ones with Lumin and Lumin Sign. Our innovative solutions work great on their own, but they’re even better together.

Lumin

An easy-to-use PDF editor that stands alone or integrates with Google Workspace.

Lumin Sign

A digital signature workflow tool that seals deals with legally-compliant signatures.

Lumin Sign API

An eSignature API designed to be plugged into your platform with minimal effort.

Used 3 times